Asymmetric Returns > Diversification > Debt Paydown

This is the formula I created and follow to grow and to increase freedom. Let me talk you through the rationale.

Disclaimer

Wealth is hard to accumulate through investing alone. The overwhelming majority of wealth builders build wealth through business. However to date, I have yet to find my business skills. I’ve built my wealth through investing alone. Learning and being successful at business is on my to do list.

Asymmetric Returns

Asymmetric returns is based on the idea that things can go up to infinity and down to zero. On regular stocks, assuming no liability, mathematically there is the ability to go up to infinity and down to zero. Said another way there can be much larger upsides than downsides.

I buy things that have an asymmetrical return - these can be sometimes identified as things that are unusually cheap

Lets say you find an investment selling at 100k. You strong reasoning to think that it would be worth 500k in a few years. And lets say the worst case scenario it could go to zero. The 5:1 ratio is a great asymmetric bet. If you are right and it goes to 500k, you are up 400k. If you are wrong you lose 100k. That’s a gamble I would take.

Sometimes Asymmetric opportunities arise when their historic price is a lot higher and for a short period of time, the price is deflated. I personally find it hard timing markets. Identifying both top and bottom is hard. I do however feel it a lot easier to identify when something is cheap. If you saw a perfectly normal Lamborghini for sale for $50k - that’s obviously worth buying.

When you see something cheap, do an upside/downside evaluation to see whether this is a potential buy. It might give asymmetric returns.

Diversification

If you can’t find any asymmetric returns - move next to diversification.

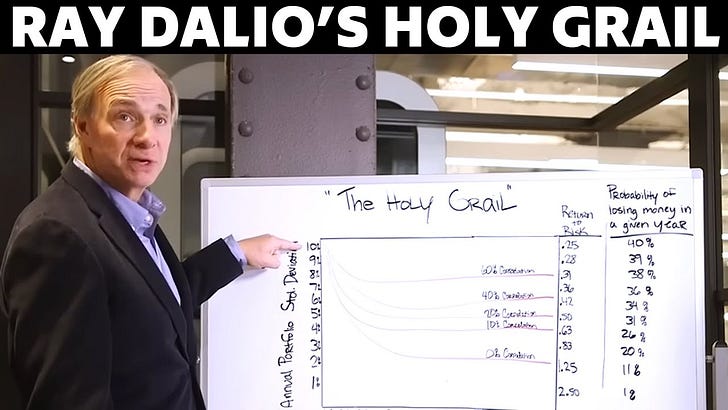

Watch this - it is very important

Take the time to understand drawdown and how uncorrelated assets reduce the impact of drawdown on your portfolio.

You have insurance on your house, your car, and perhaps yourself.

Insurance for your investments is called Diversification.

There is a cost to insurance. Its sucky paying that cost but it must be done. When you diversify there is a very, very strong chance that what you are moving money to will yield a lot less than where it currently sits.

You are looking to reduce correlation between assets that you hold and bring them up to a sensible number - perhaps 15. This doesn’t have to be immediate but the end goal that can be achieved with time.

Debt Paydown

When you cant buy things cheap or diversify then pay down debt.

Yes debt is a tool for wealth accumulation, however it comes with two caveats:

Lack of freedom

Risk of over leverage

Wealth is the pursuit of attaining freedom in a Socially accepted manner

I pursue wealth because I want freedom (in a socially accepted manner).

If you have no debt and a steady income - you are financially independent (free). If you wanted complete freedom - just become homeless. The homeless can live forever for free and have no constraints on where or when they reside. They can come and go as they please.

If you want freedom in a socially accepted manner - pay down your debt and have a steady income.

Dollar Cost Averaging

The astute reader will notice that this formula goes against the idea of Dollar Cost Averaging.

One of the features of Dollar Cost Averaging is that it negates timing markets. And yes - I time markets to a degree.

However if I was ever 100% on one type of investment, I would use Dollar Cost Averaging.

Compound returns is interesting but I prefer to focus on time to double. A simple rule of thumb for calculating the time for your money to double is the rule of 72.

If you earn 10% return - 72/10 = 7.2, so 7.2 years to double your money. Your goal is to have as many doubling periods during your lifetime as possible. So If you are 40 and you plan on retiring when you are 65 and getting 10% per year you’d get 3 more doubling periods. So if you had a million dollars at 40, you’d end up with 3 million give or take.

Your goal is to get the denominator (bottom number) as high as possible to maximize lifetime doublings.

It is far more tangible and real to think in terms of doublings rather than the abstract concept of compounded interest.