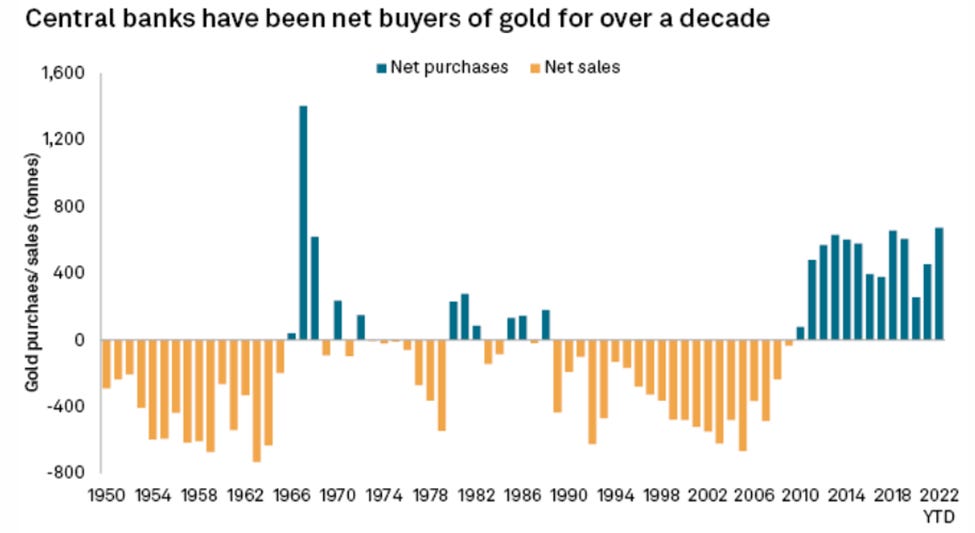

It is the year 2025. The everything bubble is peaking. Everything is overpriced. The breakneck speed of Gold acquisition by Central Banks may be decelerating for a short period of time now that the US has Trump back in power.

The graph below from mining.com clearly shows the period that we are in as a pattern of gold buying. Other numbers I have seen look like gold purchases are north of 1,000 tonnes for Central Banks.

What then might be the reasons that Central Banks are accumulating Gold?

Possibility #1 - War

There is a saying that History doesn’t repeat itself, but rhymes.

There is a stand out pattern that has been present in modern times, one where GDP drops and then a world war ensues. If you haven’t noticed NATO countries have been pushing up as far as they can against Russia and onboarding countries into the NATO alliance.

Decades of NATO rhetoric, actions and build up all signal NATO countries want conflict.

It would likely be the case that Central Banks are accumulating a traditional store of value to protect themselves to a degree from this unwanted outcome.

Possibility #2 - International Diversification

Central Banks typically hold a significant portion of their reserves in major foreign currencies, such as the US dollar. We have seen a large decline of Central Banks holding US dollars (Treasuries). Figures put it at around a decline of 12-15%.

I believe this process of de-dollarization has been sped up by Russia being kicked off the SWIFT (Society for Worldwide Interbank Financial Telecommunication) system. If such a large player could be blocked from using such a pivotal messaging system, anyone could whimsically be blocked.

In my opinion this was a huge mistake.

Firstly it signaled the biased and unpredictable nature of being a participant on the system and secondly it pushed these BRICS nations to take action in building an alternative.

Russia quickly set about building SPFS (System for Transfer of Financial Messages) as an alternate to SWIFT. Around 20 countries are now connected to this system.

A good investor pivots to either side of the coin toss. Rather than being locked into one outcome.

The USA with its advantageous situation of being the world’s reserve currency, coupled with the Petro dollar means that it has an infinite money supply hack. They can print money out of nothing, buy resources (traded in USD).

Other countries are starting to take action against this monopolistic advantage.

Possibility #3 - Domestic Diversification

Gold has historically held a low correlation with other financial instruments. You can review this video here as to why we want low correlation between assets.

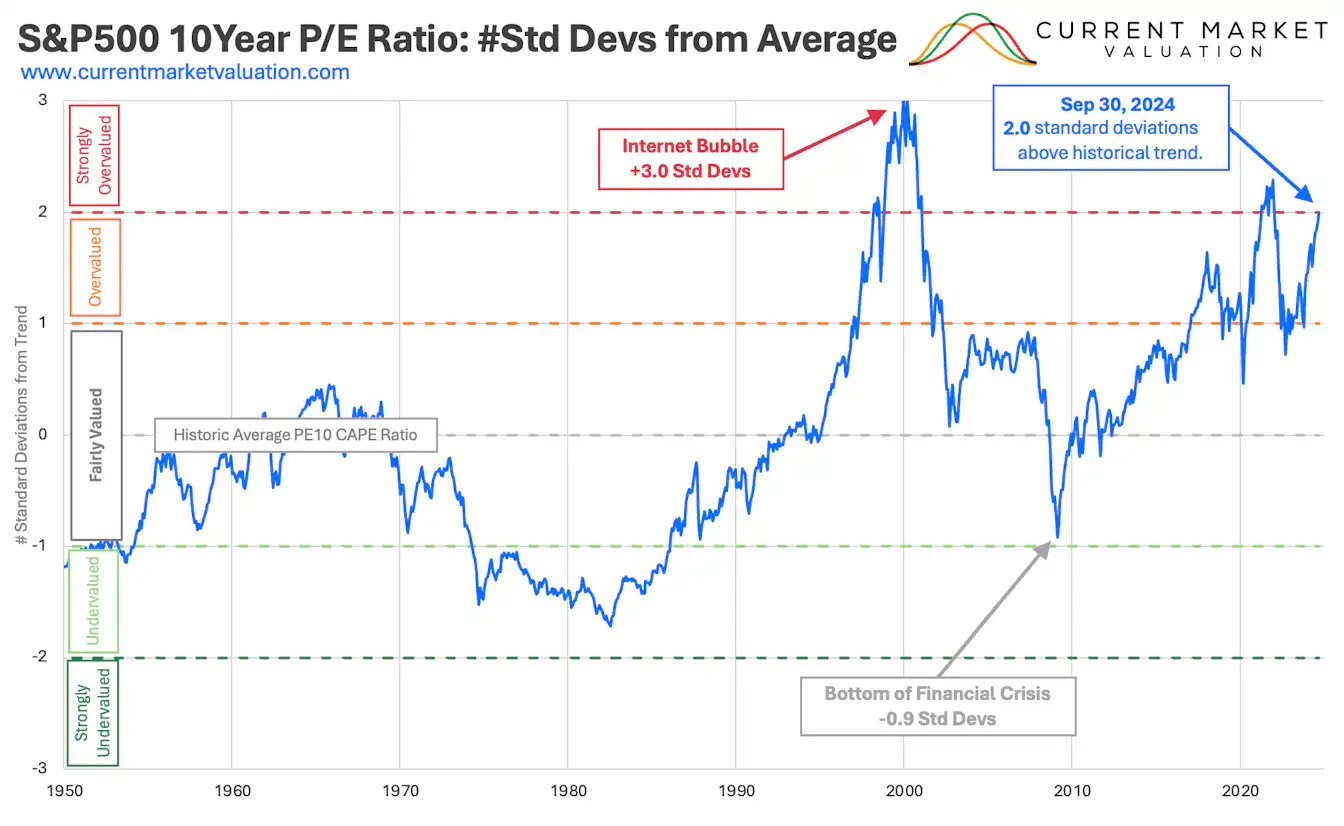

Most money from all stock markets is allocated in the USA. The Price to Earning ratio is sitting at over 2 Standard Deviations above the mean. This means that from a Price to Earnings point of view (how much we pay for a stock versus how much the company earns per year), 97.72% of all historical values are less than this point.

Or said another way - ~2% of all P/E measurements have been higher than where we are at now.

(We are extremely high)

It could well be that Central Banks are looking at softening the risk internally from the domestic banks that they support and by extension the exposure to all time high Real Estate and Stock Market prices.

Possibility #4 - End of Fiat

When a country slows down, it’s wealth may have diminished, it’s government may (probably) be larger than it should be - this is a bad situation. A situation that most countries are in now.

If you think about The Industrial Revolution. People used to do things by hand and with horses. This revolution brought a new age of technology, speed and efficiency. This in turn boosted the GDP massively.

You didn’t need 10 men and 3 horses. You now had a machine that could work 24/7.

At some point - if every country is doing this, the difference between the first adopters and the laggards soon normalizes. Eventually any competitive advantage disappears and GDP advantages disappear.

If all countries get to this state, stagnation and there are no new revolutionary GDP boosts, the country starts cannibalizing its own resources. The resource hungry Government needs resources to keep fueling the giant departments and over the top spending. Debt burdens need to be paid. Taxation can’t keep up with the demand and the dwindling productivity doesn’t help.

Countries print more and more money to pay for the costs of keeping the lights on. It’s far easier to inflate the money supply than to enrage the public asking for more and more of their income as tax - or even Austerity and taking way public services and pensions.

At some point confidence in the currency stops. Gold has historically been the defacto store of value - so a possibility could be that Central Banks are stock piling it incase of a break-glass situation.

Your Thoughts?

What are your thoughts on why the Central Banks are all accumulating gold?

If you liked anything in this article please restack!

Metals are honest money. Everything else is credit.

In a time when everyone is lying to everyone all the time about everything and no one can trust anyone with anything, credit is worthless.

Hold a gold coin in your hand and you know it's real.

Have someone tell you they have numbers in an bank account somewhere and you don't know if it's real, especially when the bank can fail or the government can come in and just freeze the account.

Worse still is without a gold backing, there's nothing stopping the government from infinitely inflating the money supply.

If you put aside $4000 in cash in a time capsule for your kids and they find it 30-40 years from now, they'll be very disappointed and think you were an idiot.

Put inside a 1oz of gold coin, and they'll never forget you.